Website Development Wordpress Development

Introduction

In today’s competitive retail and mobile financing market, managing device payments, EMI collections, and customer compliance can be a major challenge. Small business owners and mobile retailers often struggle with delayed payments, device misuse, and lack of centralized control over financed devices.

To address these challenges, we developed a complete Payment Guard EMI Solution for our client — an advanced ecosystem designed to simplify device financing, automate EMI management, and empower retailers with real-time device control.

This project imparted a full-stack digital solution consisting of:

A Laravel-based Admin Panel

A WordPress Landing Website

A Retailer Mobile App

A Customer Mobile App

Together, these components form a secure, scalable, and easy-to-use platform that helps retailers protect financed devices, manage installments, and enhance customer trust.

What is the Payment Guard EMI Solution?

The Payment Guard EMI Solution is a digital financing management system that enables retailers to sell mobile devices on EMI while maintaining control and visibility over payments and device usage.

It integrates hardware-level device control, payment tracking, and customer engagement into a single ecosystem.

Core Objectives of the Solution

Enable retailers to sell devices on EMI securely

Reduce payment defaults and risks

Provide device-level control (lock/unlock)

Automate EMI reminders and tracking

Improve communication between retailers and customers

Offer a centralized admin monitoring system

Solution Architecture Overview

1. Laravel Admin Panel

The admin panel acts as the brain of the entire system, offering full operational control and analytics.

Key Functionalities

Retailer management

Customer onboarding

Device monitoring

EMI installment tracking

Lock/unlock commands

Payment history reports

User agreement management

Notifications and alerts

Benefits for Businesses

Centralized control over all financed devices

Improved payment visibility

Data-driven decision-making

Efficient retailer monitoring

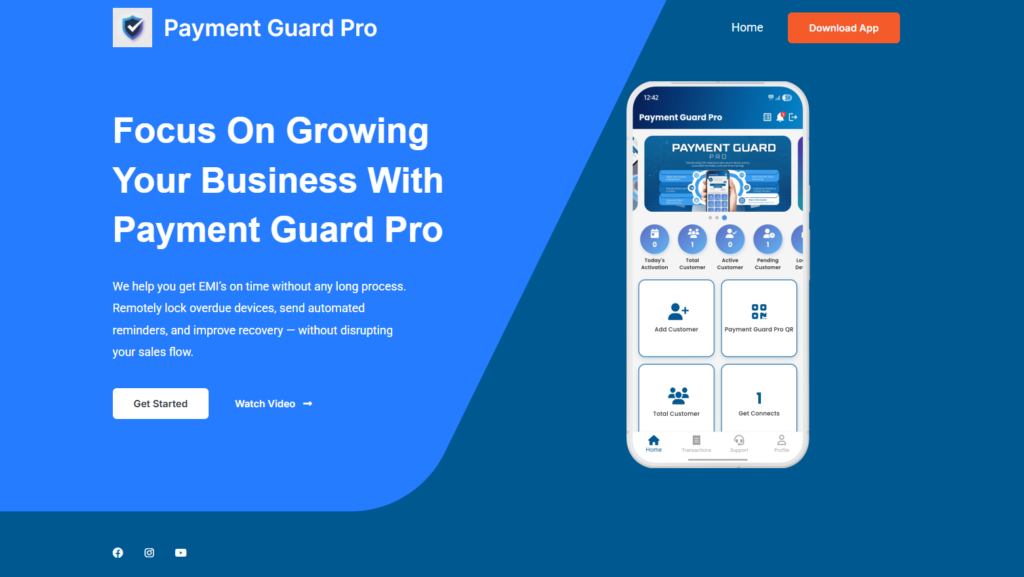

2. WordPress Landing Website

A professional and SEO-friendly landing website was developed to showcase the Payment Guard EMI platform and attract potential retailers and partners.

Website Features

Product and solution overview

Feature highlights

Benefits for retailers

Contact and inquiry forms

SEO optimization

Mobile-friendly design

This website acts as the digital front door for the product, helping businesses understand and adopt the solution.

Retailer Mobile App

The retailer app is designed specifically for mobile shop owners and device sellers who provide EMI-based device financing.

It gives retailers the power to monitor devices and payments directly from their smartphones.

Core Features of the Retailer App

Device Control

Lock device remotely

Unlock device after payment

Reboot device

Real-time device status

Customer Monitoring

Get customer location

Access device contact details

View payment behavior

EMI Management

Installment tracking

Payment status updates

EMI reminders

Security Tools

User agreement enforcement

Automated alerts

Fraud prevention support

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Customer Mobile App

The customer app empowers buyers with transparency and easy EMI management.

It ensures they stay informed about payments while maintaining device usability.

Features of the Customer App

View EMI schedule

Receive installment reminders

Lock/unlock device requests

Payment notifications

Agreement details access

Device status visibility

This app improves customer trust and reduces confusion around financing terms.

Key Functional Highlights of the Payment Guard EMI Solution

Device Lock & Unlock System

Retailers can remotely control financed devices:

Lock devices in case of payment delay

Unlock after installment clearance

Prevent unauthorized use

This ensures accountability and payment discipline.

EMI Installment Management

Automated EMI handling improves efficiency.

Schedule installment plans

Track payment completion

View overdue payments

Generate reports

Retailers no longer need manual tracking.

EMI Reminder Automation

Timely reminders reduce missed payments.

Push notifications

SMS reminders

Payment due alerts

This increases repayment rates and customer compliance.

Location & Contact Retrieval

Retailers can track financed devices for risk management.

Retrieve device location

Access stored contact details

Monitor suspicious activity

This is especially useful in high-risk financing scenarios.

User Agreement Integration

The system includes digital agreements for legal and operational clarity.

Digital acceptance tracking

Terms visibility

Consent verification

This protects both retailers and customers.

Technology Stack Used

Backend

Laravel Framework

Secure APIs

Database management system

Frontend & Website

WordPress CMS

Responsive design

SEO optimization

Mobile Apps

Android-based architecture

Real-time sync with admin panel

Device control integration

Use Case Example

Scenario: Mobile Retailer Selling a Smartphone on EMI

Retailer registers customer in the system.

EMI plan is created via admin panel.

Customer signs digital agreement.

Device is activated with Payment Guard system.

Customer receives reminders before due dates.

If payment is delayed:

-

-

Retailer can lock the device.

-

After payment:

-

-

Device is unlocked automatically.

-

This workflow ensures a secure and structured financing process.

Benefits for Small Business Owners & Retailers

Financial Security

Reduced default rates

Better payment monitoring

Increased EMI success rate

Operational Efficiency

Automation of reminders

Centralized tracking

Reduced manual work

Business Growth

Offer EMI confidently

Attract more customers

Build trust in financing

Customer Experience

Transparent payment tracking

Easy communication

App-based support

SEO & Market Advantage

The Payment Guard EMI platform gives retailers a competitive edge in the device financing industry.

Why It Stands Out

End-to-end ecosystem

Hardware + software integration

Real-time monitoring

Retailer-first design

Scalable architecture

Retailers adopting such solutions can transition from traditional EMI models to smart digital financing systems.

Future Expansion Possibilities

This solution can evolve further with:

AI-based payment risk prediction

Advanced analytics dashboards

Multi-device support

Digital payment gateway integration

Credit scoring features

Such enhancements can transform it into a complete fintech platform.

Conclusion

The Payment Guard EMI Solution represents a powerful step forward in mobile device financing. By combining a Laravel admin panel, WordPress landing website, retailer app, and customer app, we delivered a comprehensive ecosystem tailored for modern retailers.

This platform not only safeguards financed devices but also streamlines EMI management, improves customer engagement, and enhances business profitability.

For small business owners and mobile retailers, this solution opens new opportunities to expand EMI offerings while minimizing financial risks.